Running a business is full of complexities and there is hardly any doubt about this point. From arranging financial capital to start the operations to acquiring necessary approvals from respective authorities, there are hundreds of things that need to be done in systematic manner so as to avoid issues at a later stage. Among many essential things to do, one important thing a business owner should think is get a CIN number. A CIN number is an intrinsic part of a business and needs to be quite at various associations related to the business.

This unique CIN number is of extreme value as every business must be inclusive of its unique CIN in the forms given to the Ministry of Corporate Affairs (MCA), mostly for business reports and audits. This post is intended to delve deeper to precisely check the importance and features of the Corporate Identification Number (CIN).

What is a CIN Number/ CIN Code?

The CIN refers to a 21-digit unique number that is meant to help in the identification of a business in the future. It also contributes to creating the legality of a business. The CIN number is provided to all companies owned by one individual such as limited firms, private limited firms, and all other firms registered in India.

The CIN number is typically issued by the ROC. There is a ROC available in every state, and entrepreneurs need to consult their staff to setup their firms and get a CIN number.

Every state tends to have a CIN number with the exception of those in the east that fall short of the ROC. CIN refers to a unique number that helps in the formal identification and authentication of a business. All of the company’s fundamental data can easily be tracked through the CIN number.

What does a CIN number mean?

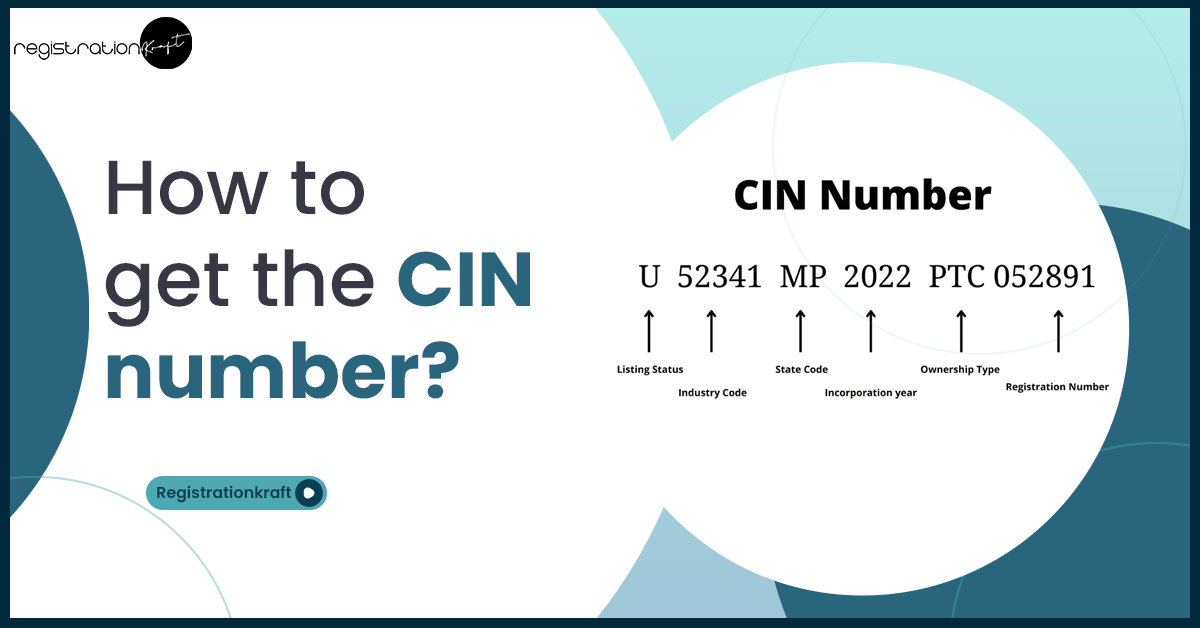

The corporate Identification Number (CIN) is comprised of numerous details, like:

- The first character of the CIN defines whether the business is listed or unlisted. If the number starts with ‘U,’ it means that it is an unlisted company, while ‘L’ refers to a listed business

- The following 5 digits define the industrial sector and doings in which the business is engaged

- The subsequent 2 digits are a shortening denoting the state of the company’s original registration (e.g., ‘UP for Uttar Pradesh)

- The subsequent 4 digits refer to the year the business is registered

- The succeeding 3 letters highlight the company’s ownership or structure type (For example, ‘PLC’ for a Public Limited Company, ‘SGC’ for a State Government Company, ‘NPL’ for a Section 8 or Not-for-Profit Company, ‘OPC’ for a One Person Company)

- The last 6 digits are unique and constitute a registration number assigned by the Registrar` of Companies (ROC). This number is most used for all kinds of official identification for the company, differentiating it from other registered businesses.

Where a business’s CIN number is mentioned?

There are several places where the CIN number of a business is mentioned such as

- Bills and invoices

- Letterheads

- Annual reports

- Notices

- E-forms

- Billheads

- Emails to other parties

- Receipts

- Business letters

Why a Company Registration Number is so important?

The Company Registration Number issued by the Registrar of Companies (ROC) primarily helps in the tracking of a firm’s operations and activities. This unique 21-digit number is meant to be provided or shown in all types of business documents and transactions related to the ROC of the respective state.

The basic details about a registered company under the Ministry of Corporate Affairs can be fetched through the use of the Company Registration Number. It enables retrieval of the business’s basic information easier. It is also used to find and follow companies at differing information stages that are kept the latest by the MCA/ROC.

How to obtain a CIN Number?

Given the specific nature of a business, one can get the Corporate Identification Number (CIN) by following the given steps:

- Get a (DSC): Get a Digital Signature Certificate (DSC) from an authorized agency, enabling the electronic validation of documents and forms online.

- Apply for a Director Identification Number (DIN): Obtain a DIN from the Ministry of Corporate Affairs (MCA). It is a distinctive identifier for each director related to the company.

- Register on the MCA Portal: Register yourself as a new user on the MCA portal by mentioning your DSC and DIN credentials.

- Start Company Incorporation on the MCA Portal: Execute the business incorporation procedure on the MCA portal by submitting various forms, necessary documents, and related fees.

- Legal Establishment with Certificate of Incorporation: Give a legal identification to your business by obtaining a Certificate of Incorporation from the MCA, confirming your company’s name, address, and incorporation date.

- Assessment and Approval by MCA: After you submit all necessary documents and incorporation forms, the Ministry of Corporate Affairs will check and approve/disapprove the application. It eventually leads to the issuance of the unique Corporate Identification Number (CIN).

Similar post: How to obtain Director Identification Number (DIN)?

The Conclusion

Now, you must have a detailed understanding of a CIN number, its importance, and how to get it. A CIN number is much needed when it comes to establishing the legality of a business. This number gives the necessary authorities the ability to keep an eye on your activities and make sure everything is going according to plan.

It is customary and necessary for companies to register in the nation. Every business owner must make sure that their firm is registered, regardless of whether it is profitable or not. When registering a business of any type, there are certain things you need to take care of. Consult us today to seek professional and reliable help regarding getting a CIN number for proprietorship and partnership firm.

FAQs

Q.1 Is a CIN number mandatory for a business?

Yes, the CIN number is thought to be mandatory for a business in India. It is considered a unique identifier for legal and regulatory objectives.

Q.2 How do I obtain my CIN registration certificate?

After getting the approval of the company incorporation application, the Ministry of Corporate Affairs allows the Certificate of Incorporation, which includes the CIN.

Q.3 Are CIN and GST the same?

No, CIN and GST are different from each other. CIN refers to the corporate identification number, which is used mainly for business identification, whereas GST refers to Goods and Services Tax number, employed for taxation purposes.