In the corporate and law-based environments, compliance is not a foreign term as it has been used at various places to ensure that a unit or activity is being carried out in adherence to the prescribed methods. If we go more technical, regulatory compliance can be defined as a level of adherence an organization pays to the applicable standards, regulations, laws, specifications, and guidelines set by the concerned authority or the government. In most cases, these regulations are imposed by the governments to safeguard the interests of someone or something.

Have you ever tried to decode the need for regulatory compliance in the business world? This is important due to several reasons. You will be shocked to know nearly 80-90% of start-ups in India wrap up their operations within the first 5 years despite India having the 3rd biggest startup ecosystem in the world. Not having the appropriate regulatory compliance is one of the culprits behind this disaster. There is an extremely importance of regulatory compliance for businesses not only in India but anywhere. In fact, it is an intrinsic part of any functional business entity.

What is Regulatory Compliance?

In the simplest way possible, a regulatory compliance refers to a set of rules and regulations set by the concerned legal authority for organization that they need to abide by while doing commercial operations. There can be different types of compliances for different types of businesses and industries that businesses operating in that industry should follow. The foremost purpose of putting in this kind of compliance is to bring high levels of transparency and ethics to a business’s functioning.

A business with the necessary regulatory compliance also reflects that the business adheres to all rules and regulations setup by the industrial body for the effective functioning of any business in that domain. But when it comes to obtaining the most apt regulatory compliance, things may not be easy for businesses due to the increased number of regulations and requirements in relation to ensure better transparency in the organization. Be it a small business or a bigger one, it is necessary for it to ensure the all the laid out rules and regulations are followed in the prescribed manner. In case of non-adherence, the business may need to face severe consequences and heavy penalty.

Similar Post : What is the meaning of statutory compliance?

What are the major advantages of regulatory compliance?

Below are some of the major benefits of following regulatory compliance for the organizations.

- Regulatory compliance levels up the transparency levels of a business which further spruces up the overall positioning of the company.

- It results in increased working efficiency of the organization.

- It mitigates the risk of any kind of penalty or punishment for the business.

- Regulatory compliance also helps in the determination and analysis of the weak points in the functioning of the organization.

- Regulatory compliance helps a business update, perceive, and improvise its working procedures.

What are the Types of Regulatory Compliance?

There are primarily two types of regulatory compliance- Internal and External

Internal Compliances: – These compliances are also called the corporate compliances of a business. They are meat to reflect a small organization upkeep upper and proper working standards and safeguard an organization’s interests from internal struggles.

External compliances: – External compliances are pretty much common to every industrial sector. These compliances come with pre-set timelines which means that the organization has to update them after a set time period. These compliances are mainly governed by the local government authorities (regulatory agencies) and they are mandatory for every business engaged in the concerned sector. They also help a business in regard to registration.

A few examples of regulatory compliance requirement

Below are a few examples of regulatory compliance across different industries.

Regulatory compliance requirements vary widely depending on the industry, location, and the specific laws and regulations that govern it.

- Healthcare Sector:

HIPAA (Health Insurance Portability and Accountability Act):

The healthcare sector in India must adhere to the instructions and regulations by the National Accreditation Board for Hospitals and Healthcare Providers (NABH (National Accreditation Board for Hospitals)) standards, the Drugs and Cosmetics Act, the Clinical Establishments (Registration and Regulation) Act, and the Indian Medical Council Act.

- Financial Sector:

Know Your Customer (KYC) Guidelines: Banks and financial organizations globally are obliged to verify the identity of their clients and keep a track of their records due to the underlying anti-money laundering (AML) regulations.

- Environmental Industry:

Environmental Impact Assessment (EIA): Several nations ask organizations to carry out EIAs (Environmental Impact Assessment) before the commencements of various projects that may cause an adverse impact on the environment.

- Data Safety:

The Information Technology Act, 2000 (IT (Information Technology) Act) and associated guidelines, such as The Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011 present the main legislation related to data privacy and security in the country.

- Aviation Sector:

DGCA Regulations: Airlines and aircraft manufacturers must abide by DGCA regulations, including features such as pilot licensing, aircraft safety, and air traffic control.

- Pharmaceutical Industry:

Good Manufacturing Practices (GMP): Pharmaceutical organizations are supposed to conform to GMP guidelines to ensure the quality and safety of their offering during manufacturing, testing, and distribution.

What businesses do to guarantee regulatory compliance?

First and foremost, they need to find out the basic requirements required to get the regulatory compliances, followed by the inspection of exact type of regulatory compliance they need for their organization. It is better to seek the help of an expert or regulatory compliance associates to get the best guidance of your regulatory compliance. Here are some common ways to comprehend the specifications related to the regulatory compliance or a company:

The first thing to be done to is check the regulatory specifications for the concerned sector. A good regulatory compliance solutions company can easily determine this. It will find out all the guidelines related to regulatory compliance n business you operate.

It is important as every sector needs to follow certain rules and regulations regarding the compliance which ensures that you are following all the general requirements.

Documenting all the compliances procedure plays a really important role because they help in auditing the organization. A fair number of documents of regulatory compliance help an organization they can avoid penalties and fines.

It is necessary for every business to monitor its standards and update them frequently. These reviews can assist an organization in determining the compliances that need renewal. This constant check helps in the maintenance of all the regulatory compliances of the business.

Important Compliances That Every Business Must Adhere To

Below are some of the most crucial regulatory compliances that every business must comfort to:

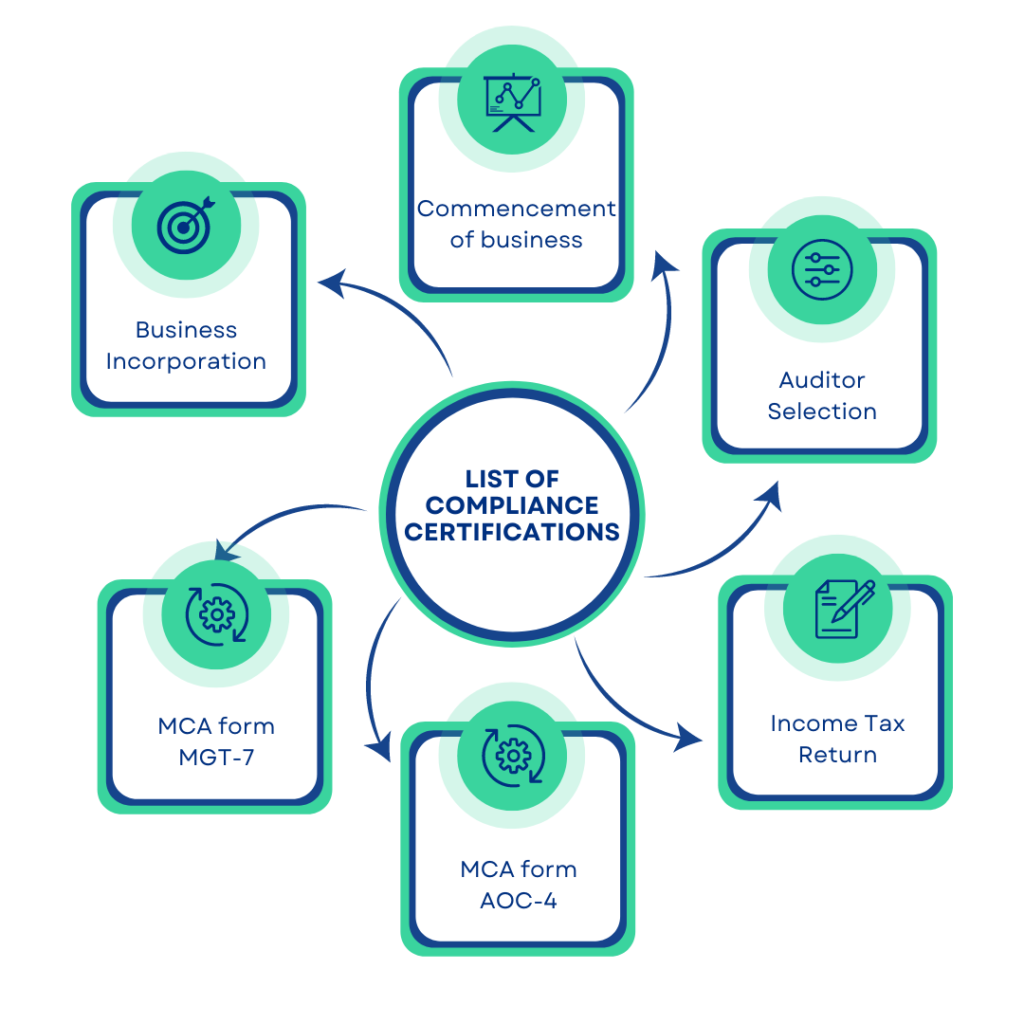

Here Is A List Of Compliance Certifications That Every Business Must Pursue:

Commencement of business (Not more than 180 days)

This type of declaration needs to be made and filed to the registrars by the directors of the business who are considered the higher authority in any organization. Business incorporation is known to be a crucial stage for each and every business and every business or organization needs to submit the declaration for its starting within 180 days of starting business. This file is supposed be announced by employing Form INC-20A. Applicants can fetch this form on the website of MCA (ministry of corporate affairs).

Auditor Selection (Within 30 days)

A certified Chartered Accountant (CA) (Under the Chartered Accountant Act, 1949) who has undergone the necessary completed in regard to the review and verification of accounting data can be appointed as an auditor. Every business needs to appoint an auditor as per the guidelines stated under the 2013 Companies Act’.

Income Tax Return

Each and every business that has been operating in India is obliged to file its income tax return on an annual basis. This helps them in ensuring their conformity to the Income Tax Act. A business can choose to file a TDS return, deposit advance tax, and submit an annual income tax return. Business can seek the help of an accounting firm or set up an in-house accounting department that can take care of this obligation in all possible ways. It is an extremely necessary step that must be taken care by every business in India.

MCA Form AOC-4

The Board of Directors and shareholders of a business can choose to employ the financial statements as a ground for determining an organization’s financial performance. The company’s annual financial statement needs to be submitted on MCA form AOC 4 to the Registrar of Companies. The form needs to be properly filed by the company within 30 days of the annual general meeting.

MCA Form MGT-7

The Ministry of Corporate Affairs (MCA) gives all businesses a digital form which is called Form MGT 7. This form is used by them to submit their annual return. This digital form is handled by the Registrar of the organization by an electronic machine and as per the company’s statement of accuracy. It is a commonly used form among businesses that need to be filed on the basis of the requirements of the ministry of corporate affairs.

Business Incorporation

The Companies Act of 2013 (the “Act”) looks after the process of creating a firm and giving a company registration certificate. The firm registrar is able to register this certificate. A private limited corporation is defined in detail in Section 2 (68) of the Companies Act of 2013. This kind of firm does not have its shares listed on the stock market; instead, investors own the company’s shares privately. Certain legal features are advantageous to a private limited company.

Support by The Government

Must need to mentioned, any kind of initiative comes with its own set of challenges. While regulatory compliance is mandatory for businesses due to its positive impact, getting it done is not as easy as it may appear. There are several hardships like the cost effect of compliance, altering the set ecosystem in company workings, and, most importantly, lack of awareness of these perks. However, the Government of India has brought a number of attractive schemes and assistances that a business can take advantage of in coming years. The Government has also decide to ease regulatory compliances. For example, it has launched various online portals for different departments, which guarantees that businesses need not to rely on any specific office and can get easy and quick information through such these portals. Other ingenuities and actions taken by the Government of India include but are not restricted to the execution of the Goods and Service Tax (GST) in 2017, which was meant to ease the indirect taxation procedure. The Companies Act, 2013, also reflected and promoted responsible business procedures to be included in Indian companies to benefit the public as well as the local economy.

The Conclusion

In a nutshell, regulatory compliance has been impacting all types of businesses in one or another ways. From a well-defined, organized way of operations to instilling trust among stakeholders and clients, the major functions of an organization can have a big and positive impact when they take regulatory compliance seriously. In general, a majority of businesses are poised to benefit and get a high rate of ROI if they abide by and adjust their operations with an objective to conform to the regulations and legislations that are relevant to them.

FAQs

What is the role of person responsible for regulatory compliance?

The personal responsible for regulatory compliance (PRRC) is supposed to look after the verification and oversight of the relevant regulatory compliances. The PRRC ensures that specific activities take place in accordance with the regulations.

What is the difference between compliance & Regulatory Compliance?

Compliance means abiding by the set rules, regulations, ethics or internal strategies. It can be inclusive of different areas, like internal policies set by an organization. On the other side, Regulatory Compliance particularly means conforming to external laws, regulations & strategies forced by monitoring bodies overriding specific businesses or sectors.