How to Block SBI ATM Card

In today’s digital era, ATM cards offer a convenient way to access your funds, but they also come with certain risks. There are instances where blocking your ATM card immediately is crucial to prevent fraud and financial loss. Before learning about the SBI ATM card blocking process, let’s explore some key reasons why you might need to block your card.

Reasons to Block your SBI ATM Card Immediately

1. Lost or Stolen Card

If you lose your ATM card or suspect it has been stolen, blocking it should be your first action. A lost or stolen card can be misused by fraudsters to withdraw money or make unauthorized transactions. Blocking the card ensures that no one else can access your funds.

2. Unauthorized Transactions

If you notice transactions on your bank statement that you did not authorize, it could be a sign of fraud. Criminals might have gained access to your card details and are using them for unauthorized purchases or withdrawals. Blocking your card can prevent further losses.

3. Card Cloning or Skimming

ATM card skimming is a common fraud technique where criminals install hidden devices on ATMs to steal card details. If you suspect that your card information has been compromised, blocking it is a smart move to safeguard your money.

4. Phishing or Scam Alerts

If you receive suspicious calls, messages, or emails asking for your ATM card details, it could be a phishing scam. Even if you haven’t shared your details, fraudsters might attempt unauthorized access. Blocking your card in such cases adds an extra layer of protection.

5. ATM Card Retained by Machine

Sometimes, an ATM machine may retain your card due to a technical issue or entering the wrong PIN multiple times. If this happens, it’s best to block your card immediately to prevent any misuse until you get a replacement.

6. Suspicion of Hacking or Data Breach

Banks and financial institutions sometimes report data breaches where customer information, including ATM card details, might be exposed. If your bank informs you about a security breach, blocking your card and requesting a new one is a proactive step to protect your account.

Process of Blocking SBI ATM Card

Losing your ATM card or noticing suspicious activity? Don’t worry! Blocking your SBI ATM card is quick and simple. Just follow these steps to secure your account:

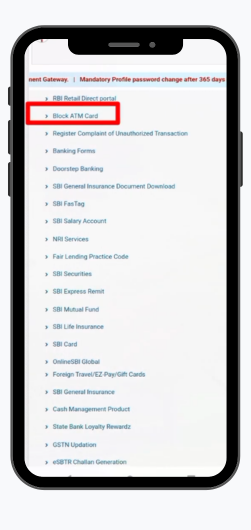

Step 1: Go to the State Bank of India’s official website.

Step 2: Scroll down and click on the “Block ATM Card” option.

Step 3: Click on “Next” to move forward in the process.

Step 4: Enter Your Details

Fill in the required information:

- Account Number

- Country

- Registered Mobile Number

- Enter the text shown in the image for human verification

Now, click on Submit.

Step 5: Verify with OTP

A one-time password (OTP) will be sent to your registered mobile number. Enter it to proceed.If you don’t receive the OTP, click on “Resend OTP” to get another one.

Important: Never share your OTP with anyone. If you enter the wrong OTP three times, the transaction will be canceled, and you’ll need to restart the process.

Step 6: Choose the ATM card number & Blocking Type:

- Select the ATM card number you want to block and choose between:

- Temporary Block – You can unblock your card later by visiting an SBI branch

- Permanent Block – Once your card is blocked, it cannot be reactivated.

Caution! You cannot unblock your ATM card online once it is blocked.

Step 7: Confirmation

That’s it! Your SBI ATM card is now successfully blocked. You will receive a confirmation message on your registered mobile number.

Need further assistance? Visit your nearest SBI branch or contact SBI customer support. Stay safe and secure!

Conclusion

Your ATM card is a key to your hard-earned money, and taking immediate action in case of any suspicious activity is crucial. Blocking your card at the right time can prevent fraud, unauthorized transactions, and financial loss. Always stay alert and keep your bank’s emergency contact details handy to act swiftly in case of an issue.

Related Post : How to Generate SBI Debit Card PIN?

Categories: Banking

Tags: