How to Become Seller on Amazon in India?

Amazon is the largest online retailer and cloud computing service provider in the world. From small businesses to major companies, many are registered on Amazon to sell their products to customers.

If you’re a seller, you should consider selling on Amazon as it offers a massive customer base, global reach and an extensive logistics network. In this blog post, we will explain to our readers how to sell products on Amazon in India in an easy and simple manner.

About Amazon: Founder, Establishment Year & Product Offerings

Amazon.com was founded by Jeff Bezos, in 1995, in the United States. It is a leading e-commerce and cloud computing giant. Not many know that it was originally an online bookseller.

In today’s time, it has expanded to sell a vast array of products like electronics, clothing, furniture, home goods, gold jewellery, silver jewellery, skincare, haircare and grocery items. The Amazon CEO & President is Andy Jassy. He succeeded founder Jeff Bezos in July 2021.

Amazon entered India in 2013 by launching Amazon.in. The website provides sellers with a platform to reach a large base of customers and access smooth logistics services. For the buyers, it is often the go-to shopping destination for purchasing products across various categories.

Documents Required to Sell on Amazon India

To sell products on Amazon India, the following documents are required:-

- GST Registration Certificate.

- Aadhaar Card.

- Trademark Registration (not mandatory but recommended if you want to sell branded products).

- Industry specific licenses and registrations, such as FSSAI license if you want to sell food items or BIS hallmark registration if you want to sell gold jewellery.

- Bank Account Details for receiving payment (cancelled cheque or bank statement).

- PAN Card (Individual/Business).

- Business Address Proof (Utility bill or lease agreement).

Amazon Seller Registration Process in India

The Amazon Seller India registration process involves several steps. Below, we have explained each step you need to fulfill to complete Amazon seller account registration successfully. After going through all the steps, you will be able to understand how to become seller on Amazon.:-

Step 1: Go to sell.amazon.in and then click on ‘Start Selling’ to create your account to be able to sell on Amazon in India.

Step 2: If you already have a customer account on Amazon.in or Prime Video, you can use the same email and password for Amazon seller account creation. Once you login, enter the OTP to verify your mobile number. If you don’t have a customer account, then click on “Create your Amazon Account” and enter details like name, mobile number, email address and set up a password. Then, click on ‘Continue’.

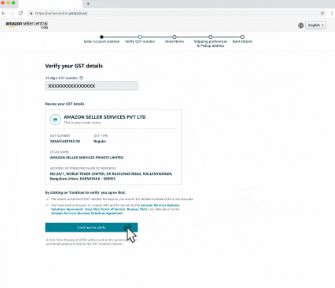

Step 3: After signing in, you must enter your GST number. In case you want to sell GST-exempt products, choose option ‘‘I only sell tax-exempt products such as books’.

Step 4: After entering the GST number, you must click on ‘Continue to Verify’ option. Then, on the next screen, you need to click on ‘Upload GST document’. Once you upload the GSTIN certificate, click on the ‘Submit GST document’. The verification for GST can take up to 72 hours. While the document is under review, continue with the remaining steps.

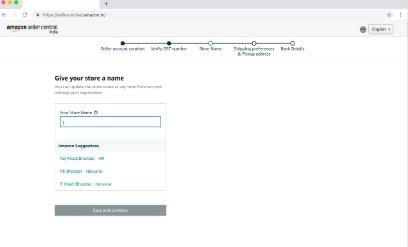

Step 5: Now, pick a unique store name to make your Amazon.in store stand out.

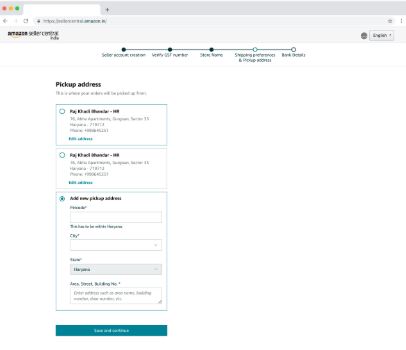

Step 6: Then, you must add pick up address details. This is the location from which Amazon will collect products for orders placed by customers. Also, you need to choose your preferred shipping method.

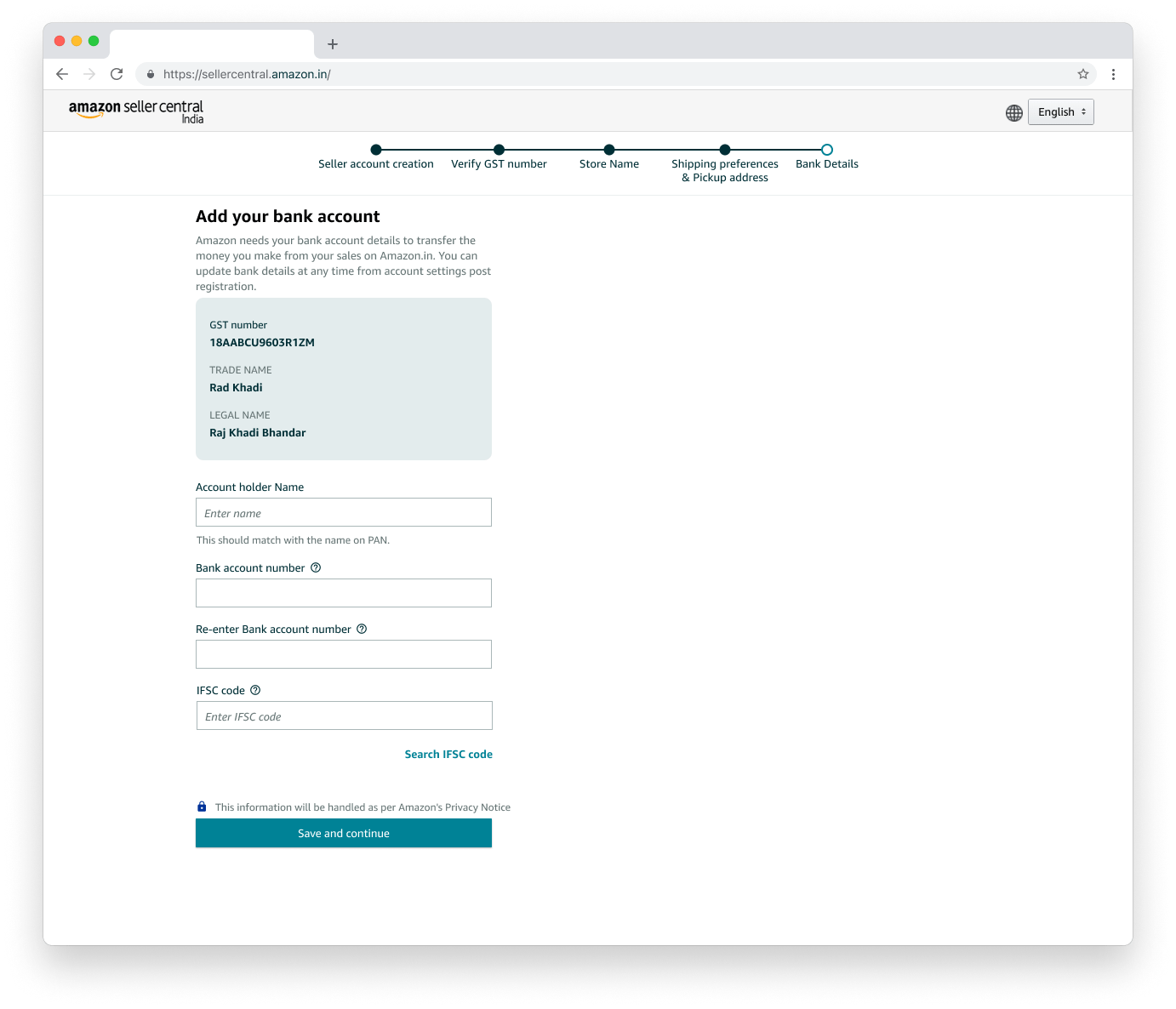

Step 7: For this step, enter details of the bank account you use for business transactions.

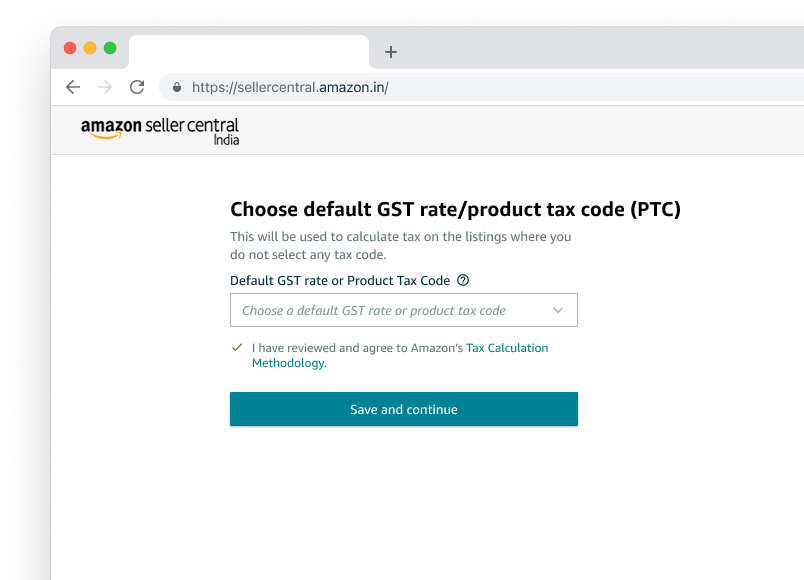

Step 8: Then, select the Default GST rate or Product Tax Code (PTC) for your product listings.

Step 9: Afterwards, click on ‘Add products and start selling’ so you can begin listing. For launching your store on Amazon.in, this is a mandatory step.

Step 10: Once product listing is completed, click on the ‘Start selling’ button as the final step.

After completion of all the above steps, you will be registered as an Amazon in seller.

Conclusion

Amazon.in is a leading platform for both buyers and sellers. Whether you are a sole proprietor, a small business or a big company, registering on Amazon.in as a seller would be beneficial for you. In this blog post, we explained to our readers how to become Amazon seller. If your goods are not GST exempt, then make sure to obtain a GST registration certificate as soon as possible. This certificate is necessary for completion of the registration process. For assistance in obtaining this certificate, you can connect with our GST consultants at Registrationkraft! We’d love to help you out!

Frequently Asked Questions (FAQs)

Q1. Can I sell on Amazon without GST?

Yes, you can sell on Amazon without GST as long as the products you intend to sell are specifically exempted from GST. However, if your products are not GST exempt, it is mandatory to obtain GST registration to ensure compliance with the legal requirements.

Q2. Is selling on Amazon profitable?

Yes, selling on Amazon can be a profitable venture provided that you focus on certain factors like implementation of effective advertising strategies so more customers can discover you, offer high quality products at competitive prices so more customers purchase from you, proper management of inventory and choosing products with high margins.

Q3. Can I sell on Amazon USA from India?

Yes. As an Amazon seller, you can sell on Amazon USA from India under Amazon’s Global Selling program. This program makes it possible for Indian sellers to list and sell their products on Amazon USA.

Similar Post: Flipkart Seller Registration for Selling Products Online

Disclaimer: In this article, we tried our best to present reliable and up-to-date information to our readers. However, we do not guarantee 100% completeness or accuracy of the information. This content should not be interpreted as financial, legal or business advice. It is for informational purposes only.

Categories: Business

Tags: